Understanding which dental insurance in the United States covers implants is always very useful. Insurance that has the option of fully or partially paying for dental implants is a benefit of great importance. This is because getting dental implants is one of the most expensive treatments out there.

In the United States, we find a wide variety of dental and medical insurance that does not take care of this type of issue. So, we can see ourselves in the situation of needing to get dental implants and not being able to count on our insurance. The usefulness of this article is to tell you which dental insurance in the United States does cover implants.

Miami Perfect Smile: We accept dental insurance in the U.S. that covers implants

At Miami Perfect Smile we want your smile to be beautiful and radiant. That’s why today we bring you this post, in which we will tell you what the dental insurance plans in the US are that cover dental implants. If you need a dental implant treatment in Miami, you can consult with us through any of our contact channels. You can also schedule an appointment so that we can provide you with complete advice.

At Miami Perfect Smile we accept all types of dental insurance that our patients are covered with. In addition, our prices are very suitable for high-quality treatments. Many people from other states in the country travel to Florida for dental treatments, including implants. Despite travel expenses, treatment costs are still cheaper than in other States.

We put all our effort into performing high-precision treatments, with the best materials on the market and using state-of-the-art technology. In our facilities, you will always receive the careful and specialized treatment you deserve. Your well-being is our goal. Check the opinions of our patients and check their satisfaction with our treatment. Pleased patients are our best letter of introduction.

7 Dental Insurance Plans in USA covering implants

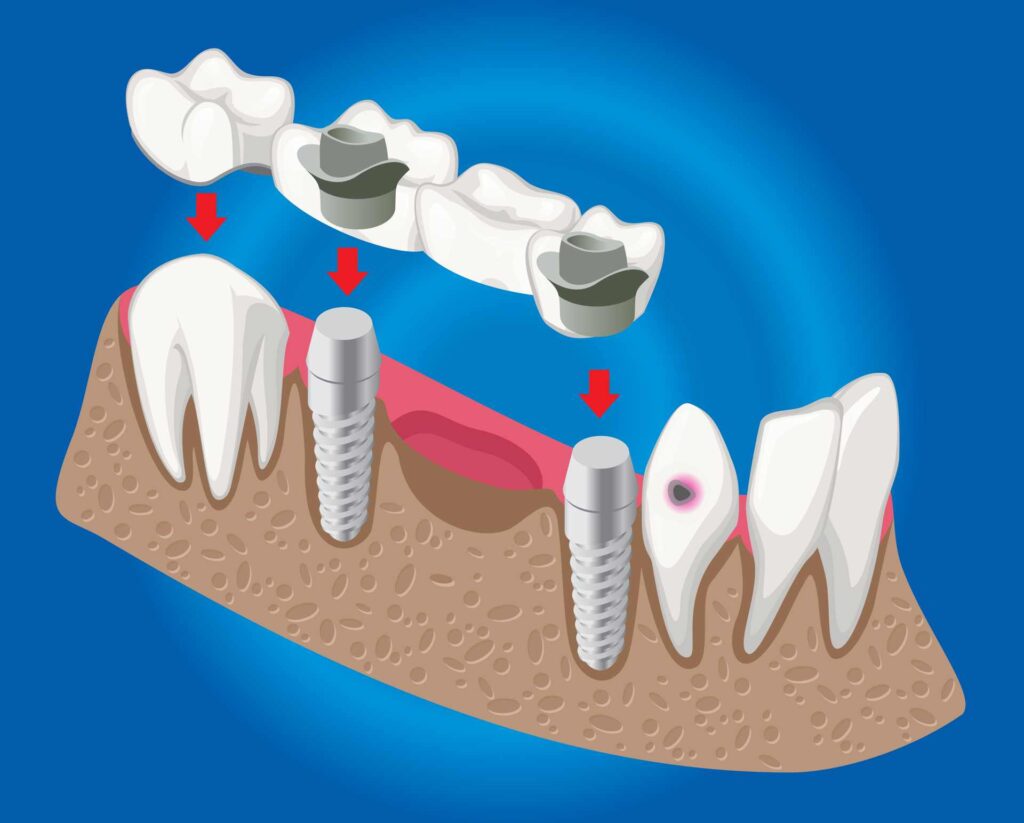

It is no easy task to find dental insurance in the U.S. that covers dental implants. Many dental insurances do not consider this type of treatment, because they consider them an aesthetic procedure, that is, not so necessary or vital. However, the truth is that dental implants can be the solution for many dental problems, especially for those who are edentulous or for those who have several pieces in poor condition.

In particular, from a certain age onwards, it is advantageous to have dental insurance that does cover dental implant treatments. Getting the implants can be quite expensive and having the support of dental insurance is not a crazy idea, since it is possible to save from several hundred to thousands of dollars. In this regard, we have good news for you: yes, it is possible to find dental insurance in the U.S. that covers dental implants. Next, we will show you the best dental insurance plans which do cover implants in our country.

1) Delta Dental Insurance in the U.S. covering implants

Delta Dental is an insurance plan specialized in dental health, which was founded in the year 1954. It enjoys widespread popularity, which has led it to having insured more than 80 million Americans from its emergence to the present day. This insurance is available in 50 states of the country, including the State of Florida, so it is among the most important dental insurance providers in the country.

It is undoubtedly among the best dental insurance plans in the U.S. that cover dental implants, with several policy options. In addition, it provides online quotes, which can be very helpful when choosing from several plans.

Pros of Delta Dental Insurance

Among the pros of Delta Dental are that:

- You have the option to cover dental implants in many of your plans.

- It can provide cover tailored to the needs of patients.

- It has both individual and family plans.

Cons of Delta Dental Insurance

The cons of this insurance are as follows:

- It has annual maximums and deductibles.

- It does not always cover pre-existing conditions in patients.

- It proposes 50% coverage for major procedures such as dental implants.

Individual Delta Dental Plans Covering Dental Implants

- Delta Dental PPO Plan: Has 50% coverage for implants.

- Delta Dental Premier Plan: Has 40% coverage for implants.

- Delta Dental’s Pro Plus Premier Plan: It has 40% coverage for implants or 30% for out-of-network coverage.

An example of Delta Dental’s Pro Plan insurance

Let’s now take an example of this dental plan, to get an idea of how it works. It covers 100% of the costs of procedures and diagnoses, as well as routine dental check-ups. It covers 80% of basic dental treatments such as fillings, root canals and extractions. And it covers 50% of major procedures, such as dental implants, bridges, etc.

By applying annual maximums and deductibles, you can greatly decrease the coverage of the implants, and this is something to consider. It may also not cover pre-existing conditions, so it will be difficult for you to apply if there is already a lack of teeth.

2) Dental Insurance from Anthem in USA covering implants

Anthem is one of the most popular insurance plans covering implants in the U.S. It has a total of 41 million insured subscribers nationwide. It has an extensive network of clinics and doctors of 108,000 participating providers. This insurance plan has a stellar rating granted by AM Best for its good financial strength.

Anthem has several types of plans, ranging from individual to family, and employer. Anthem dental insurance is present in 14 states: California, Colorado, Connecticut, Georgia, Indiana, Kentucky, Maine, Missouri, Nevada, New Hampshire, New York, Ohio, Virginia, and Wisconsin. It is not based in the State of Florida.

Pros of Anthem Dental Insurance

Among the pros of Anthem are that:

- It offers monthly premiums that, while not the lowest, maintain a reasonable level.

- It provides extensive benefits in its plans.

- It has an annual maximum of $2000 or $2500, which is among the highest.

- It transfers the unused annual maximum to add it to the following year.

Cons of Anthem Dental Insurance

The cons of this insurance are as follows:

- It has annual maximums and deductibles.

- Maintains a 6-month waiting period for dental implants.

- Determine variable rates based on location and demographics.

- It is present in very few States.

- It has slightly higher rates than other insurance plans.

Anthem plans that cover dental implants

Anthem’s basic dental insurance does not cover implant treatments, but only the costs of preventive care, routine exams, cleaning, and x-rays. Some may even offer some coverage for basic services such as fillings, but the client always has to make a financial contribution.

However, there are several major service or full-coverage dental insurance options, which do provide coverage for dentures, dentures, bridges, or implants. Full coverage does not imply that the insurance will cover 100% of the costs. Depending on the type of plan, the monthly premium that is paid, and the annual cap, it will be the percentage that will be covered by the insurance.

- Essential Choice PPO Silver Insurance: Includes implants with a 50% coinsurance and a waiting period of 6 months. It has an annual maximum of $1000 per person and monthly premiums of $50.

- Essential Choice PPO Gold Insurance: Includes complex services such as implants, with a coinsurance of 50% and a waiting time of 6 months. It has an annual maximum of $1500 per person and monthly premiums of $50.

- Essential Choice PPO Platinum Insurance: Includes complex services such as implants, with a 50% coinsurance and a waiting time of 6 months. You have a $150 deductible. With an annual maximum of $2000 per person and monthly premiums of $50.

- Essential Choice PPO Incentive Insurance: Includes complex services such as implants, with 50% coinsurance and no waiting time, plus a $150 deductible. The year after acquiring it, the percentage of coinsurance is reduced. With an annual maximum of $2500 per person and monthly premiums of $50.

3) Insurance from Denali Dental & Vision in the USA covering implants

Denali Dental & Vision insurance is one of the most balanced in terms of price and services it provides. It is among the insurance plans with the highest amount of annual coverage, which can reach up to $ 6000, which is quite significant. Insurance plans can be tailored to customers’ needs.

This insurance company has 60 years of experience. It is supported by the financial group Renaissance Life & Health Insurance Company of America, which has been rated “A” or excellent in terms of financial strength by the AM Best agency. This means that Denali Dental is an insurer with sufficient financial solvency to meet its obligations to its policyholders.

It operates in most States however, not in them all. You can buy this insurance plan in any of the following states: Alabama, Arizona, Arkansas, California, Colorado, District of Columbia, Florida, Georgia, Hawaii, Idaho, Indiana, Iowa, Kentucky, Louisiana, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Nebraska, Nevada, North Dakota, Ohio, Oklahoma, Oregon, Rhode Island, South Carolina, Tennessee, Texas, Vermont, Virginia, West Virginia, Wisconsin, Wyoming.

Pros of dental insurance from Denali Dental & Vision

Among the pros of Denali Dental & Vision are:

- The longer the wait time, the more coverage benefits accrue.

- It covers dental implant services in all of its plans.

- It has plans adaptable to the needs of the insured.

- Rated “A” by AM Best, as insurance with excellent financial strength.

Cons of Denali Dental & Vision Dental Insurance

Some cons of this insurance plan are that:

- It has variable prices according to the area of the country.

- It is not available in all States (there are 16 States in which it is not present).

- Family plans are capped at $6000, regardless of the number of individuals.

- The amounts of the monthly premiums are variable, depending on where you live and the type of plan. They range from $51 to $116.

Denali Dental & Vision Plans Covering Dental Implants

- Denali Summit Plan: Has 100% coverage for preventive services. It has 50% coverage for diagnostic services, as well as 30% for basic and major services, among which are dental implants. This 30% applies during the first year of the insurance contract. Until the fourth consecutive year of this plan’s contract, the amount of coverage of basic and major services increase, to finally cover 60%.

- Denali Ridge Plan: It has 100% coverage for preventive services and 50% for diagnostic services. During the first year, it maintains 10% coverage for basic and major services, including dental implants. During the first 4 consecutive years of contract with this insurance, the percentages of coverage increase, reaching 80% in diagnostic services and 50% in basic and major services.

4) Renaissance Dental Insurance in the USA covering implants

The Renaissance Dental is an insurance plan that stands out for the low costs of its policies. It belongs to the Renaissance Family of Companies group, which offers insurance for several areas, such as vision insurance, life insurance or disability insurance. The company was founded in 1957. Currently, the dental insurance area has more than 13.1 million policyholders nationwide and pays a sum of 3 billion for dental care annually.

It has 2 plans that include coverage for dental implant treatments. We can find this dental insurer in the following states: Arkansas, Georgia, Florida, Indiana, Kentucky, Michigan, New Mexico, New York, North Carolina, South Carolina, Ohio, Tennessee, Texas, and Nevada.

Pros of Renaissance Dental Insurance

Some of the advantages of this insurance plan are:

- Your least expensive policy stays at half the price of the overall best rate.

- It provides good coverage with low monthly premiums. For women under 50 it can be only $35 a month.

- It offers the possibility to choose any dentist.

- It has more than 55 years of experience and 300 thousand access points in its network.

- There is no waiting time to receive refunds.

Cons of Renaissance Dental Insurance

Some cons of this insurance are that:

- The main coverage requires a waiting time of 1 year.

- Not all plans are available in all states.

- You have an individual deductible of about $50.

Renaissance Dental Plans Covering Dental Implants

- Renaissance Dental Plan II: Offers 50% coverage for dental implants up to an annual maximum of $1000 per person. It has lower monthly premiums, of $50 per person, which makes it a more affordable plan than Plan III (which we will see after this one). However, preventive and diagnostic care are not fully covered but only up to 50%.

Minor and major services, including dental implants, are covered by 50%. For some minor services (such as periodontal maintenance and filling-type restorations), there is a 6-month waiting period. For all major services the waiting time is 12 months. Subscribers can choose any dentist in-network or out-of-network.

- Renaissance Dental Plan III: Maintains 50% coverage for dental implants up to an annual maximum of $1000 per person. It offers 100% complete coverage for preventive and diagnostic care with in-network dentists, and up to 80% coverage with out-of-network dentists.

Regarding basic services it has a waiting time of 6 months and coverage ranging from 100 % for emergency treatments within the network and 80% outside the network. It covers 80% for x-rays, minor restorations, and in-network periodontal maintenance, and 60% out of network. For simple extractions and other basic services, in-network or out-of-network coverage is 50%.

For the main services, a waiting time of 12 months applies, except for coatings and repairs, in which it covers 80% within the network and 60% outside the network. Other major services, including implants, are covered by 50% in-network or out-of-network.

5) Spirit Dental & Vision Insurance in the USA covering implants

Spirit Dental & Vision insurance has the great advantage of not having waiting times to access your benefits. It has been founded for 20 years and belongs to the Ameritas Life Insurance Corp. group, which has a long history since its foundation in 1880. Spirit Dental belongs to the Ameritas Dental Network, which is one of the largest in the country. Providers in this network agree to charge policyholders between 25% and 50% less than regular rates. It has an “A” rating from AM Best, and an “A+” rating from Standard & Poor’s thanks to its outstanding financial strength.

The States in which Spirit Dental and Vision Insurance operates in are: Alabama, Arizona, Arkansas, California, Colorado, District of Columbia, Delaware, Hawaii, Idaho, Indiana, Iowa, Maine, Maryland, Michigan, Minnesota, Missouri, Nebraska, Nevada, New Hampshire, North Carolina, North Dakota, Ohio, Oklahoma, Oregon, South Carolina, South Dakota, Tennessee, Utah, Virginia, Vermont, West Virginia, Wisconsin and Wyoming.

Pros of Spirit Dental & Vision Insurance

Some of the advantages of Spirit Dental & Vision are that:

- It has a customer satisfaction guarantee of 30 days after the plan goes into effect, with a refundable premium in case you have not required services.

- You can choose an in-network or out-of-network dentist.

- It allows access to any treatment within the plan, with no waiting time.

- It includes implants and major services from the first month.

- It has annual maximums of up to $5000 per person.

- Only a lifetime deductible of $100 is made.

Cons of Spirit Dental & Vision Insurance

Some of the disadvantages of this insurance are that:

- It does not cover pre-existing conditions (such as missing teeth).

- Annual maximums are gradual.

- For the first 3 years, low annual coverage limits apply.

Spirit Dental & Vision Plans Covering Dental Implants

- Spirit Dental Core Network: This is the most popular dental insurance within Spirit Dental & Vision. It has an annual maximum of $1200 and has a monthly premium of approximately $37.47. Prevention and diagnostic services include 3 cleanings and 2 100% covered exams per year.

Basic services during the first year are covered by 50%, 65% in the second year and 80% in the third year. Major services include dental implants and are covered by 25% for the first year. From the second year the coverage will be 50%. This insurance does not require waiting time for any of the services it offers. In-network or out-of-network dentists can be chosen. However, the most profitable are those within the network, as they have an agreement to charge between 25% and 50% less in treatments.

- Spirit Dental Pinnacle Network: It is the plan with the highest coverage within the Spirit Dental options. It has an annual maximum of $ 5000, which is acquired in the third year. Rising from $1200 in the first year, and reaches $2500 in the second year. It has a monthly payment of approximately $47.23. The deductible is $100 for life. This insurance does not need waiting time to access any of its benefits.

Preventive and diagnostic services offer 3 cleanings and 2 exams 100% free per year. Coverage of basic services will increase until the third year, starting with 50% in the first year, then 60%, and finally 80%. The main services include dental implants, and their coverage will increase every year. During the first year it will be 25%, in the second year it will be 30%, and in the third year 50%.

- Spirit Dental’s Preferred Senior Network: Offers an annual maximum of $3500, starting from the first year. The deductible is $100 for life. He has a monthly premium of $54 per person. Includes preventive and diagnostic services with 3 cleanings and 2 tests 100% free per year. Basic services have a coverage of 65% in the first year, then 80% in the second year, and reach $90 in the third year.

Major or primary services include implants, such an important treatment for some older adults. During the first year they cover only 10%, which becomes 50% during the second year, to reach 65% in the third year. In addition, it provides a bonus of coverage for hearing services.

6) Cigna Dental Insurance in the U.S. Covering Implants

Cigna dental insurance is recognized in the U.S. for being the provider that gives the best benefits in group plans. Because of this, this insurance is widely used by employers, even if they need to cover dental implants. It is available in 49 states and the District of Columbia. Individual and family plans have a varied rate (depending on the type of plan) of annual maximums and deductibles, but there are good group options that void both payments.

This insurance plan covers both implants and dentures or dental prostheses that will be supported by them. Cigna was created in 1972, and currently has more than 18 million users. In addition, it has spread to 30 other countries. It includes an extensive network of 92. 700 suppliers and 309,000 locations nationwide.

Pros of Cigna Dental Insurance

Some of the pros of this dental insurance are that:

- It does not involve annual maximums.

- You have no deductibles.

- It has adequate rates for a plan that includes implants.

- It covers many types of implants.

Cons of Cigna Insurance

Among the disadvantages of Cigna we find:

- A primary care dentist should be chosen.

- To access the specialized consultations, a reference must be acquired.

- Treatment coverage varies depending on where you live and the plan you choose.

Cigna Plans Covering Dental Implants

Cigna’s group plans are not easy to understand, as there is no information on the network. However, we can say that there are two types of very beneficial group plans, which include dental implants:

- Cigna DHMO Plan: Includes dental implants in coverage. It allows you to save through co-payments, coinsurance, and discounts. There are some limitations with implants, as you can only replace a crown, scale, or prosthesis on implant every 5 years. Likewise, the surgical procedure to install an implant is limited to one annually. In addition, the replacement of current implants is limited to one every 10 years.

- Cigna Plus Savings Plan: It consists of a dental discount plan that allows users to save money on all dental procedures, as long as they are going to perform them with the participating providers.

7) Physicians Mutual Dental Insurance in the U.S. That Covers Implants

Physicians Mutual is the U.S. dental insurance preferred by seniors. It is available in all states of the nation. It covers more than 350 procedures, including dental implants (in any of its plans). It does not include annual maximums or deductibles, which is a relief for people suffering from various dental conditions.

Physicians Mutual was created in 1902. In addition to dental insurance, it offers life insurance, health insurance, pet insurance, among others. It has favorable reviews for its financial strength in AM Best. It manages an extensive network throughout the country, which includes 500 thousand suppliers. Although it allows the freedom to go to any dentist, it guarantees an average saving of 33% of the price if you go to the dentists in the network.

Pros of Physicians Mutual Insurance

The most outstanding advantages in this dental insurance are that:

- It does not involve annual maximums.

- Does not include deductibles.

- It has 500 thousand suppliers scattered throughout the States of the nation.

- It covers more than 350 procedures, including dental implants.

- Premium rates are affordable for seniors.

- It provides a 31-day satisfaction guarantee with a full refund.

Cons of Physicians Mutual Dental Insurance

Some of the disadvantages of this dental insurance are that:

- Requires a 12-month waiting period to get the higher coverage.

- There are no discounts for retirees or seniors.

Physicians Mutual Plans Covering Dental Implants

- Physicians Mutual Economy Plus: It is the cheapest plan, with a monthly premium of $30.1. The insured has access to the same products as the other plans, only that the insurance coverage will be lower and more will have to be paid for the treatments. Preventive and diagnostic benefits begin with no waiting time and help cover 30 services. Basic services include 100 types of services and start being active after 3 months. Major services begin after one year and include 200 types of services, including dental implants.

- Standard Plus from Physicians Mutual: It’s a comfortable payment plan, with a fairly cost-effective rate of $37.8 a month. There are no differences with the previous plan, only that with this plan the insurance coverage is a little higher.

- Preferred Plus from Physicians Mutual: It is the most popular within Physicians Mutual insurance plans. It has a monthly premium of $46.75. The biggest benefit it has is that it covers a higher percentage of the cost in major treatments, such as dental implants. There is no annual limit or deductible. Provides immediate coverage for preventive and diagnostic services such as exams, x-rays, and cleaning. Basic care services have a waiting time of 3 months. Coverage for major services has a waiting time of 12 months. It is the insurance that has the highest percentage of coverage.

Comparison table between dental insurance in the U.S. that covers dental implants

Below is a comparative table, thanks to which you can more easily access the information on the best dental insurance in the U.S. that covers implants. We hope that this information will be very useful to you when choosing dental insurance that covers implants.

| TABLA COMPARISON OF 7 DENTAL INSURANCES IN THE U.S. THAT COVER IMPLANTS | |||||||

| DENTAL INSURANCE COMPANY | TYPES OF PLANS THAT COVER DENTAL IMPLANTS | ANNUAL COVERAGE LIMIT | WAITING TIME | IN-NETWORK PROVIDERS | DEDUCTIBLE | STATES IN WHICH THIS INSURANCE IS AVAILABLE | NUMBER OF INSURED |

| 1) Delta Dental | 3 plans that cover implants:- Pro Plan- Foreground- Pro Plus Foreground | Variable according to the plan | 12 months | Network of more than 198. 000 dental offices nationwide | Variable according to the plan | Available in all States | More than 80 million insured |

| 2) Anthem | 4 plans that cover implants:- Silver- Gold- Platinum- Incentive | $1000 to $2500 depending on the type of plan | 6 months for major services in Silver, Gold, and Platinum plans. None for the Incentive plan | Network of 108,000 participating clinics and doctors | Silver and Gold have no deductibles. Platinum and Incentive have $150 a year | Available in 14 States: California, Colorado, Connecticut, Georgia, Indiana, Kentucky, Maine, Missouri, Nevada, New Hampshire, New York, Ohio, Virginia y Wisconsin | 41 million insured |

| 3) Denali Dental & Vision | 2 plans that cover implants:- Summit- Ridge | Up to $6000 after 4 years. For family plans the same annual limit is maintained | It has no waiting time. But the percentages of benefits increase over the years until the 4th year, in which the highest benefits of each plan are acquired. | Network of more than 300. 000 dental centers | One-time deductible of $100 in-network or $200 out-of-network | Available in 34 States: Alabama, Arizona, Arkansas, California, Colorado, District of Columbia, Florida, Georgia, Hawaii, Idaho, Indiana, Iowa, Kentucky, Louisiana, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Nebraska, Nevada, North Dakota, Ohio, Oklahoma, Oregon, Rhode Island, South Carolina, Tennessee, Texas, Vermont, Virginia, West Virginia, Wisconsin, Wyoming | More than 13.1 million policyholders |

| 4) Renaissance Dental | 2 plans that cover implants:- Plan II- Plan III | $1000 | 12 months | Network of more than 300. 000 dental centers | $50 per person and $150 per family | Available in 14 States: Arkansas, Georgia, Florida, Indiana, Kentucky, Michigan, Nuevo México, Nueva York, Carolina del Norte, Carolina del Sur, Ohio, Tennessee, Texas y Nevada | More than 13.1 million policyholders |

| 5) Spirit Dental & Vision | Several plans that cover implants, among them are:- Core Network- Pinnacle Network- Network Preferred by Seniors | Up to $5000 per person, after 3 years | No timeout | Network of 111,500 dental centers | One-time deductible of $100 per person | Available in 33 States: Alabama, Arizona, Arkansas, California, Colorado, District of Columbia, Delaware, Hawaii, Idaho, Indiana, Iowa, Maine, Maryland, Michigan, Minnesota, Missouri, Nebraska, Nevada, New Hampshire, North Carolina, North Dakota, Ohio, Oklahoma, Oregon, South Carolina, South Dakota, Tennessee, Utah, Virginia, Vermont, West Virginia, Wisconsin, Wyoming | Unavailable |

| 6) Cigna | 2 plans that cover implants:- Plan DHMO- Plan Plus Savings | Vary by plan | Varies depending on the plan | Network of 92. 700 providers and 309,000 care centers nationwide | $50 per person and $150 per family | Available in all States | More than 18 million policyholders |

| 7) Physicians Mutual | 3 plans that cover implants:- Economy Plus- Standard Plus- Preferred Plus | No timeout | No time for preventive services, 3 months for basic services and 12 months for major services | Network of 500,000 care centers and providers | Deductibles are not included | Available in all States | (Data not available) |

Things to consider if you’re looking for dental insurance in the U.S. that covers implants

To get our dental insurance to cover the implants, we must choose well the type of plan we will hire. It is important to consider some issues, as they will facilitate the choice and access to coverage of dental implants.

Verify that the plan covers dental implants in major services

Not all dental insurance plans include implants in their clauses. Some companies consider dental implants to be aesthetic, and for this reason, exclude them. For many other companies, implants fall into the category of major services and are covered, but only in full coverage plans and not in basic plans. Full coverage plans usually have a higher monthly premium than basic ones.

Waiting time to cover implants

In most cases, insurance companies require a waiting time to provide some of their services. This time varies between 3, 6, and 12 months, and only after the lapse has elapsed, the insured can access basic and major services (where implants are included). So, if we need treatment as soon as possible, we must choose a plan that does not have waiting time or that has the minimum possible.

However, when the insurance does not include waiting time to access the implant service, it is usual that the percentage of coverage is minimal for the first year. This means that it must be considered that it may be more expensive to perform the treatment.

Percentage of coverage for dental implants

A no less important detail is that, in some plans, the percentage covered by the insurance to provide the major services increases over the years. For example, you can start by covering only 10% of the implant treatment during the first year and increase until you reach a considerable percentage (such as 60% or 80%)) in the fourth year.

This type of management usually does not ask for waiting time to perform the treatment of implants. However, even so, the insured will obviously want to wait for the insurance to apply the highest percentage of coverage possible. Other plans require a pre-party waiting time of 6 or 12 months and provide 50% coverage on implants when the waiting time has already elapsed. In any case, we must consider each of these variants and chooses the one that best suits our needs.

Exclusions for pre-existing conditions

Another detail to consider before deciding on an insurance that covers dental implants, are the exclusions for pre-existing conditions. Exclusions can determine that certain people who before taking out insurance already had some type of dental problem (such as the lack of a tooth), are not a candidate to be paid for the treatment of implants. It is best to purchase at least one insurance plan that covers the cost of any treatment required by the area related to the missing tooth. Otherwise, it can make the so-called out-of-pocket expenses more expensive on the part of the insured, but it is all about implant treatments. In case we have any pre-existing conditions, it is best to find a plan that does not stipulate this condition.

Annual Coverage Limits

Many dental insurance policies place annual coverage limits, which range from $1000 to $2,5,00. This figure could cover a single dental implant, so the patient will have to pay the rest of the money from his pocket. In some plans, annual coverage is cumulative, and what was not consumed one year, is added to the coverage of the following year. This causes some patients to wait to accumulate several years of coverage so that the insurance covers a good part of the cost of the implants.

On the other hand, there are some insurance plans that have a higher annual coverage limit, which can be around $5000 and $6000 a year. This is already a considerable figure if it comes to implants. However, usually, this type of annual coverage so high is obtained after 3 or 4 years of contributing to a plan, so the benefit of dental insurance cannot be enjoyed immediately.